Corporate bonds have always been part of balanced portfolios, but their role is expanding. Investors who once treated them as background income holdings now use them to create reliable cash flow, reduce volatility and improve post-tax returns. Greater transparency, better trading infrastructure and easier access have turned what was once a quiet corner of the market into a purposeful part of wealth planning.

A corporate bond is a simple promise: a company borrows money and agrees to pay interest on schedule before returning the principal at maturity. What matters today is how investors are structuring this part of their portfolios to meet both short-term liquidity needs and long-term capital goals.

Why More Investors Are Turning to Bonds Intentionally

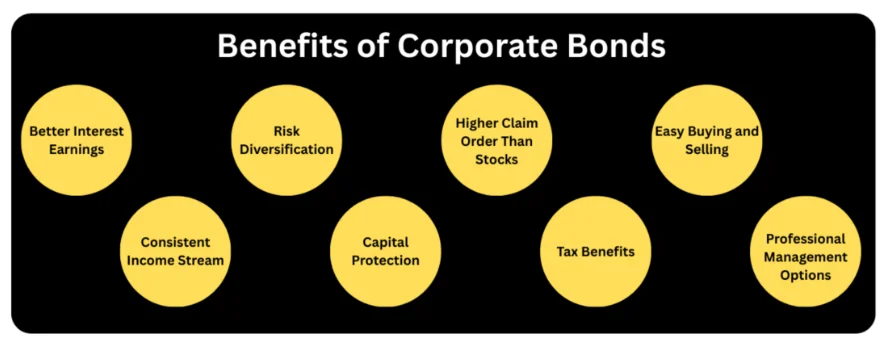

Listed below are the key reasons why many investors are adding corporate bonds to their portfolios:

1. Steady and planned income

Interest payments arrive on fixed dates, which helps match cash inflows to expenses or reinvestment goals. This predictability is valued by investors who want to fund ongoing commitments without disturbing equity or private market positions.

2. More productive use of conservative capital

Money kept in deposits or ultra-safe instruments often grows too slowly. High-quality corporate bonds typically offer better coupons while keeping risk measured. Even a one or two percent improvement on large sums can significantly lift overall portfolio returns.

3. Stability during market uncertainty

Equities and alternatives can swing sharply with sentiment and global events. Bonds usually fluctuate less and, when held to maturity, deliver the agreed interest and principal regardless of short-term price moves. This steadiness helps preserve capital when markets are unsettled.

4. Improving ability to exit when required

Liquidity once made many investors cautious. Today, trading data and digital access make it easier to know which issues can be sold if cash is needed. This visibility has encouraged more active and confident bond investing.

5. Efficient taxation

Listed corporate bonds held beyond one year attract long-term capital gains tax at 12.5 percent without indexation. For high-income investors, this rate can improve real returns compared with certain other fixed-income products.

Where Corporate Bonds Stand Against Other Investment Choices

When allocating fixed-income capital, corporate bonds sit between the safety of deposits and the volatility of equity:

- Deposits give certainty and insurance protection but pay relatively modest rates. Bonds require evaluation but reward that work with higher potential income.

- Government securities have very low default risk but also lower yields. Corporate bonds introduce issuer risk yet compensate with better coupons.

- Debt mutual funds offer diversification and professional management but charge fees and mark holdings to market daily. Direct bonds allow investors to lock rates and hold to maturity.

- Equities are designed for growth but fluctuate sharply. Bonds bring stability and predictable income, balancing an otherwise aggressive portfolio.

The best results often come from using these instruments together. Corporate bonds occupy the space where safety and return meet.

Strategies to Take in Account for Corporate Bond Investments

To manage corporate bond investments, here are some things to consider or factor in:

a. Focus first on credit strength

Begin with issuers rated AAA or AA. These companies usually have robust balance sheets and repayment records. Once a stable base is in place, add selected A-rated or slightly lower names for higher yield only after thorough credit analysis.

b. Assess liquidity before you buy

Not every bond trades actively. Check trading volumes and bid-ask spreads to understand how easily it could be sold later. Highly rated, shorter-maturity bonds usually offer smoother exits.

c.Spread exposure intelligently

Avoid concentrating in one issuer or sector. Diversify across industries and maturities to reduce the impact of any single downgrade or default.

d. Plan maturities to match cash needs

Build a ladder where some bonds mature sooner and others later. This approach keeps liquidity flowing and lets you reinvest at prevailing interest rates over time.

e. Factor taxation into the plan

Plan holding periods to benefit from long-term capital gains treatment. Align maturity dates with other income flows to avoid heavy tax events in one year.

f. Stay alert after purchase

Monitor credit ratings, issuer announcements and interest rate trends. Take action early if fundamentals weaken or better opportunities appear.

g. Use professional input for complex allocations

Large portfolios benefit from expert guidance on selecting issuers, balancing credit risk with cash flow and integrating bonds with global and equity holdings.

Main Routes to Invest in Corporate Bonds

Here that the different ways you can invest in corporate bonds:

Buying listed bonds on stock exchanges

NSE and BSE list corporate bonds that investors can buy directly. This route gives control and transparent pricing but requires comfort with evaluating issues and monitoring liquidity.

Debt mutual funds

Funds pool capital into diversified bond holdings managed by professionals. They suit those who want simplicity and diversification but accept management fees and daily price fluctuations.

Bond dealers and private brokers

Registered intermediaries offer access to new issues and secondary market bonds, along with research and price negotiation support for larger investments.

Digital bond marketplaces

Online platforms now display live yields, ratings, maturities and trading data. They make it possible to invest smaller amounts while keeping pricing and liquidity visible.

RBI Retail Direct

Although aimed primarily at government securities, this platform also provides access to certain corporate bonds, giving investors a secure and direct online channel.

Each route varies in control and effort. Active investors often prefer exchanges or digital platforms; those wanting simplicity may use brokers or funds.

How to Make Corporate Bond Investments?

Here is an outline of how corporate bond investments work:

- Define the purpose. Clarify whether your allocation is for steady income, capital protection, or higher yield.

- Gauge your risk tolerance. Decide how much credit and interest rate exposure you are comfortable taking.

- Screen for quality. Use ratings to filter issuers, then study their financials and repayment record.

- Decide on maturity structure. Build a mix that matches upcoming cash needs and uses laddering for long-term flexibility.

- Check liquidity signals. Review trading history, market demand, and bid-ask spreads before buying.

- Model tax impact. Plan holding periods and structures to improve after-tax yield.

- Select the right access channel. Choose between direct exchange buying, brokers, funds, or digital platforms based on how actively you want to manage holdings.

- Monitor regularly. Track rating changes, issuer performance, and interest rate shifts. Adjust if conditions change.

This process keeps bond investing disciplined and aligned with the broader wealth strategy rather than left to chance.

Bringing Expertise into the Process

Corporate bond investments create dependable income, preserve capital during volatility, and make conservative funds work harder. But success depends on informed selection, awareness of liquidity, and careful integration with other assets. Evaluating issuers, structuring maturities, planning tax impact, and monitoring credit require skill and time.

Shriram Wealth offers specialised support in building corporate bond portfolios. Their experts can help you choose strong issuers, design a maturity plan that fits cash flow needs, optimise for taxes, and keep the allocation aligned with your long-term financial vision.

FAQs

1. Why add corporate bonds if a portfolio already has equities and alternatives?

Corporate bonds provide reliable income and controlled downside. They help stabilise returns when growth assets become volatile, supply liquidity for planned spending or reinvestment, and allow defensive capital to earn more than bank deposits without taking excessive risk.

2. How should credit quality shape a bond allocation?

Begin with a strong base of AAA or AA rated issuers for principal protection and liquidity. After building this foundation, add carefully selected mid-tier names to enhance yield, but only after reviewing the issuer’s balance sheet, cash flows and repayment record.

3. What is an effective maturity structure for large allocations?

A laddered approach works well. Hold a mix of short-term bonds for rolling liquidity, medium-term for stable income, and a few long-term issues to lock attractive coupons. This structure manages reinvestment risk and reduces the need to sell growth assets during market stress.

4. How do changes in interest rates affect a bond strategy?

Rising rates lower the market price of existing bonds. Holding to maturity preserves the agreed coupon and principal. If early sale might be needed, keep part of the portfolio in shorter maturities. Laddering and periodic rebalancing help adapt to rate movements.

5. How can liquidity be assessed before buying a bond?

Review actual trade data such as average daily volume, bid and ask spreads, and recent exit activity. Highly rated and shorter-tenor bonds usually trade more actively and are easier to sell at fair value. Large positions should be tested with dealers or platforms before investing.

6. Are corporate bonds tax efficient for high income investors?

Yes, if structured thoughtfully. Interest payments are taxed as regular income, but long-term capital gains on listed bonds held for more than one year are taxed at 12.5 percent without indexation. Planning maturities and sale timing can improve post-tax yield.

7. What role do international bonds play alongside Indian corporate bonds?

Many investors combine high-quality Indian bonds for rupee income with selected offshore debt to diversify currency exposure and interest rate cycles. Coordinating both can help reduce overall portfolio risk and improve flexibility.

8. Is it better to buy individual bonds or invest through debt funds?

Direct bonds give control over maturity, cash flow, and exit decisions, which suits large allocations. Debt funds add diversification and professional management but are marked to market daily and charge management fees. The choice depends on desired control and monitoring ability.

9. How often should a significant bond allocation be reviewed?

At least once a year and sooner if there are credit rating changes, major shifts in interest rates, or liquidity events in the market. Continuous monitoring allows early action if an issuer’s financial strength weakens.

10. When is professional advice valuable?

Professional advice is valuable when allocating large sums, blending multiple maturities and credit tiers or integrating bonds with global and alternative assets. Experts can help you optimise issuer selection, tax planning, and liquidity management. This way, the bond allocation meets precise portfolio goals.