Your Wealth Partners

Building partnerships rooted in trust

Who Are We?

Shriram Wealth is the newest addition to Shriram Group’s 50+ year legacy of delivering reliable financial solutions. Supported by Sanlam Group’s 100 years of expertise, it combines two trusted names to offer focused wealth management services.

We make wealth management simple, ensuring every decision aligns with your unique aspirations.

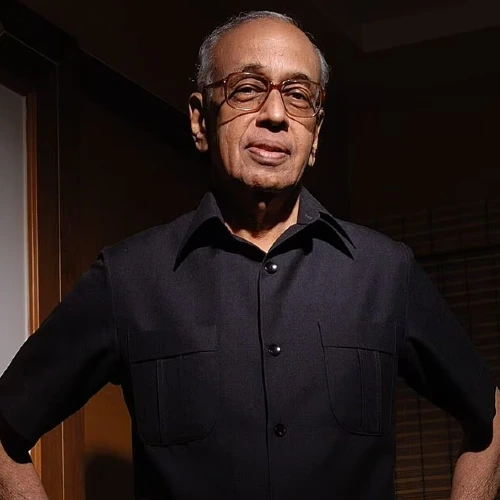

Mr. R.Thyagarajan

Founder - Shriram Group

Our Founder

Mr. R.Thyagarajan, has been a driving force behind the company’s growth and commitment. His leadership continues to inspire innovation and trust in financial services.

Paul Brendan Hanratty

CEO – Sanlam Group

Our Partner

Discover our partnership with Sanlam group, a diversified financial services company headquartered in South Africa, with a strong presence in 31 countries, covering 28 countries across the African continent and a niche presence in Asia.

Our Advisory

Council

Ajay Sheth

Founder, Quest Foundation

Ajay Sheth, a commerce graduate and cost accountant, has over 38 years of experience in the Indian capital markets. His career began with multinational companies like Procter & Gamble and Roche Products before he transitioned into equity research in 1987. Specializing in mid-cap and small-cap stocks, his research services quickly gained a strong following among FIIs, mutual funds, and institutional investors. In 2007, he launched Quest Flagship PMS, delivering consistent alpha through a bottom-up stock selection approach. As of December 2024, Quest Investment Advisors manages approximately INR 3,000 crore (USD 350 million) in equity assets. Beyond his professional success, Mr. Sheth is a passionate philanthropist. In 2008, he founded Quest Foundation, a charitable trust supporting education, healthcare, and livelihood creation. Mr. Sheth has pledged 100% of his share of profits to the foundation, reflecting his commitment to societal betterment and empowering marginalized communities.

Dr Harsh Vardhan

Management Consultant & Financial Sector Expert

Dr Harsh is a management consultant and was a Partner and Senior Advisor with leading international management consulting firm Bain & Company. He has over 30 years of experience in the financial sector in India and globally where he has advised top management of companies in India, North America, Europe, Southeast Asia, Indo China, and Greater China, on issues of strategy, operations, organisation, risk management, etc. He has worked extensively on issues of corporate finance including mergers and acquisitions, alliance structuring and negotiations, valuations, review of major investment decisions for private equity and strategic investors, strategic due diligence, etc.

Dr Harsh is actively involved in policy making related to financial sector in India. He chaired the Committee on the Development of Securitisation for Housing Finance appointed by the RBI in 2019. Recently, he was a member of the Cross Border Insolvency Rules of Regulations Committee (CBIRC) of the Ministry of Corporate Affairs. He was a member of the Banking Working Group of the Financial Services Legislative Reforms Commission (FSLRC) set up by the Government of India as well as the Dr P J Nayak Committee on Governance in Banking set up by the RBI. He has been an expert witness to the Standing Committee on Finance of the Parliament on issues relating to financial sector regulation and the role of RBI. He has served on the CII National Committees for Private Equity, Regulatory Affairs and Commodity Markets. He regularly contributes articles and is a frequently invited speaker at conferences on Indian economy, banking and finance sector.

He is an Independent Director on the board of Karur Vysya Bank and had served earlier as the Chairman of the board of National Commodities Clearing Ltd..

Harsh has a Bachelors degree in Mechanical Engg from VNIT Nagpur followed by an MBA in Finance and Banking from IIM Kolkata, and an MS in Quantitative Finance and PhD in Business Economics & Strategy from the Smith School of Business of the University of Maryland USA.

Paul Wilson

CIO at Sanlam Multimanager International

Paul joined Sanlam in 2011 as an investment analyst; was subsequently appointed as Head of Manager Research in 2013 before being appointed to his current position of Chief Investment Officer (CIO) in 2017. As CIO, Paul heads up a substantial team of experienced investment professionals who look after R410bn of client funds.

As solutions architects, the team performs in-depth macro and manager research that informs the portfolio construction process, which is encompassed within a disciplined framework.

Before joining Sanlam, Paul fulfilled the roles of Head of Asset Manager research and senior Investment Consultant at Jacques Malan Consultants & Actuaries. He also gained experience as a Quantitative Analyst at RisCura Solutions.Paul is a CFA Charterholder and also has a BSc (Honours) in Actuarial Mathematics from the University of Pretoria.

Sridhar Gorthi

Founding Partner, Trilegal

A founding partner of Trilegal, Sridhar Gorthi serves on the firm’s management committee. He is a part of the corporate practice group, and is considered an authority on corporate law, M&A and private equity in the country. Sridhar has been actively involved in several high-profile cross-border and domestic transactions. His experience spans an array of sectors, including manufacturing, pharmaceuticals, insurance, banking and financial services, technology, telecom and media. He has represented international clients on inbound M&A in India as well as Indian companies on outbound M&A transactions in diverse jurisdictions such as the UK, the USA, South Africa and Indonesia. In the last decade, Sridhar has worked on some of the biggest and marquee M&A transactions in India.

CREDENTIALS

- Education: National Law School, Bengaluru

- Admissions: Bar Council of Maharashtra and Goa

RECOGNITION

- Ranked in Chambers and Partners - Asia Pacific and Global for Corporate/M&A and Private Equity (2025-2014).

- Among India Business Law Journal’s, A-list 2024 of top 100 lawyers in India.

- Asian Law Firm Leader of the Year - Asia Legal Awards 2023, Nishant Parikh and Sridhar Gorthi, Trilegal

- 'Highly Regarded’ – M&A, IFLR1000 (2019 - 2024).

- 'Leading Individual' - Corporate M&A, Legal 500 Asia Pacific (2024)

- ‘Distinguished Practitioner’ for Corporate M&A and PE – Asialaw Profiles (2024).

SELECT REPRESENTATIVE MATTERS

Heineken

acquisition of a controlling stake in United Breweries.

Goldman Sachs

investment in Aragen Life Sciences.

Piramal Enterprises

acquisition of Dewan Housing.

acquisition of Dewan Housing.

RARE

acquisition of Star Health Insurance.

Qualcomm Ventures (QV) and World's largest and highest-valued semiconductor chip manufacturer*

proposed $100 million investment in JIO Platforms.

Dr. Subramanian

Ex MD, Axis Capital

Dr. S Subramanian brings more than 38 years of financial services expertise across investment banking and equities Currently Dr Subramanian is on the Advisory Board of a Private Equity Investment Committee and a Strategic consultant to a multi- billion dollar Indian multinational groupHe was the Managing Director and ran the Investment banking and equities business of AxisCapital and Enam for over 20 years Prior to that he ran Equity Research at UBS in India and was the country head of HG Asia and Head of Equity Research at DSP Financial Consultants He holds a PhD in Finance from IIM, Ahmedabad.

Our

Leadership

Vikas Satija

Managing Director and Chief Executive Officer

A seasoned finance professional with 27 years of experience in banking, wealth management, and asset management, Vikas has played a key role in setting up Kotak Mahindra Bank's Private Banking and Affluent Businesses, where he served for 19 years. Prior to this, he contributed to the launch of asset management businesses at Reliance AMC and HDFC AMC. An MBA in Finance, Vikas has also attended executive leadership programs at ISB Hyderabad and IIM Ahmedabad.

Naval Kagalwala

Chief Operating Officer & Head of Product

With 28+ years of experience in financial services, Naval has expertise in Banking, Secured Lending, Capital Markets, and Wealth Management. He previously led Wealth Management at Axis Bank, helping it become the third largest in the industry. Naval has also worked at ENAM Securities and Citibank. He holds a post-graduate degree in management from Mumbai University and is a graduate of the Institute of Cost and Works Accountants of India.

Anirban Mallick

Senior Executive Director & Business Head, Client Relations (South & East)

Anirban joins Shriram Wealth with 23 years of experience in managing HNI portfolios. He has led global organizations like ABN AMRO, RBS, DBS, and Kotak Mahindra Bank, excelling across multiple regions. An alumnus of ICFAI Business School (2002), Anirban is known for his leadership, strategic insights, and relationship-building skills. Beyond his career, he is dedicated to philanthropy and passionate about football, embodying teamwork and perseverance.

Nidhi Agrawal Sachdeva

Executive Director & Business head (West) – Client Relations

Nidhi brings 21+ years of experience in Banking and Financial Services, including being part of Kotak Mahindra Bank’s founding team. She has expertise in Wealth Management and Priority Banking, with leadership roles at Infosys, Axis Burgundy, and SALT, focusing on finance for women. Nidhi holds a Masters in Finance and Investments from Nottingham University (UK) and an Executive MBA from IIM Bengaluru.

Puneet Asthana

Executive Director & Chief Technology Officer

Puneet will lead technology transformation at Shriram Wealth with 24 years of experience in IT strategy and digital transformation. He has led teams at ICICI Securities, HDFC Securities, and Reliance Communications, overseeing cloud migrations and technology changes. His expertise includes IT governance, cybersecurity, digital transformation, and enterprise architecture. With an engineering degree, an executive MBA, and an MDP from ISB, Puneet’s leadership drives growth at Shriram Wealth.

Let's Grow Your Wealth, Together

Mumbai

The Capital, A wing, 1st Floor, Unit No. 110, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.comDelhi

Shriram Wealth, 409, Southern Park, Saket district centre, Saket, New Delhi

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.comGurugram

Seva corporate park, Unit no 201A, M.G road, DLF phase 2, sector 25, Gurugram, Haryana – 122002

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.comBengaluru

2nd Floor, TS Towers, Coffee Day Square, Vittal Mallya Rd, near Cubbon Park, Bengaluru 560001.

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.comHyderabad

Shriram Wealth Ltd, 11th Floor, Rajapushpa Summit, Nanakramguda Village, Serillingapally mandal, Rangareddy District, Financial District, Hyderabad, Telangana Pin: 500032

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.comChennai

Shriram Wealth Ltd, 1st Floor, No. 221, Royapettah High Road, Luz, Mylapore, Chennai, Tamilnadu Pin: 600004

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.comKolkata

Shriram Wealth Ltd, 2nd floor, J B House, 2. Upper Wood Street, Kolkata: WB Pin: 700016

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.comAhmedabad

C-808, The First, Beside ITC Narmada, Keshav Baug, Satellite, Ahmedabad

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.comPune

Park Plaza, 9th floor Ganeshkhind Rd, Akashvani Rashtriya Film Sangrahalay Quarters, Model Colony, Shivajinagar, Pune, Maharashtra 411016

Toll-free Number: 18002683996

(Available from 9am-6pm on all business days) Email: support@shriramwealth.com