The notion that retirement planning is best left until one’s late 30s or 40s is steadily losing relevance. All thanks to increasing awareness and growing appeal of early retirement by choice. At the same time, there is also the risk of forced retirement due to layoffs, health issues or unforeseen events, which makes it even more important to plan and start as early as possible. People are starting to realise that retirement planning has less to do with age than with clarity of purpose.

A well-thought-out retirement plan is about defining the lifestyle one wishes to maintain, the obligations to be met and the legacy to be preserved. Yet achieving this vision requires more than just high income.

In the 2025 India Wealth Survey done by Marcellus, it was found that around 43% of respondents save less than 20% of their post-tax income. Many of them hold a large share of assets in real estate, leaving less room for diversification. At the same time, challenges such as suboptimal returns and limited clarity around investment choices continue to hold them back.

It suggests that wealth alone does not ensure security or choice in retirement. Instead, what matters is a deliberate strategy. The one that aligns resources with ambitions, accounts for risks and recognises the need for adaptable income streams.

This article deliberates on the steps for building clarity for your retirement. It will assist you in creating a more secure financial future and support your path to true financial independence.

Clarify retirement objectives

Begin by clearly articulating the retirement objectives. This could be maintaining a particular standard of living, supporting family members across generations or pursuing broader goals such as philanthropy or leaving a lasting legacy. For instance, if your current monthly expense is ₹1 lakh, and you are 40 years old planning to retire at 60, with an average inflation rate of 6%, the same lifestyle may require nearly ₹3.2 lakh per month after 20 years. This kind of calculation helps translate objectives into tangible numbers. Such clarity helps align your personal aspirations with realistic plans.

Assess financial readiness

For this, you need to consider all your assets, be it equity portfolios, business interests, real estate or alternative investments such as real estate, gold, etc. Account for liabilities like loans or personal guarantees. Alongside, evaluate which assets are liquid and capable of generating regular returns, since both are essential for meeting expenses post-retirement. From the current pool of assets, it is also important to earmark a portion specifically for retirement needs, as other goals such as children’s education or property investments may require separate allocations. This helps evaluate your overall financial standing. This further assists in understanding your insurance needs, protecting your assets and managing potential risks.

Take, for example, a retired sports professional. While endorsement income and royalty streams may continue, they often decline over time. Therefore, planning is essential.

Planning involves projecting cash flow, accounting for variable income and evolving expense patterns such as healthcare costs or travel. A clear assessment of the balance sheet and income statement enables the design of a sound retirement strategy. Furthermore, building various scenarios such as varied market returns or interest rates into the plan is essential in order to create a resilient plan.

Establish a strategic asset allocation

When you have investments spread across different asset classes, it is important to decide how much you want to hold in each over the long term. Strategic asset allocation is about setting these target proportions carefully. It considers your comfort with risk, the returns you need and how long you plan to stay invested.

Once you have defined the mix, creating a framework that guides investment choices even during volatile market time becomes clear. It helps keep your portfolio aligned with your goals and supports consistent progress toward the retirement lifestyle you want to maintain.

A list of investment avenues for you | |

Fixed-Income InstrumentsFixed Deposits | Market-Linked InvestmentsMutual Funds |

Real AssetsReal Estate (Physical Property) | Protection-Linked ProductsInsurance (Traditional & ULIP-based Investment Plans) |

Precious MetalsGold (Physical & Digital) | Alternate & Private InvestmentsPrivate Equity |

Plan for tax-efficiency

Tax considerations are central to retirement strategy. They shape how much wealth is ultimately preserved for future needs. For example, managing capital gains effectively means planning the timing and structure of asset sales can help reduce overall tax outgo.

Another approach is to include instruments like REITs or InvITs in your portfolio. While their dividends are taxable, they offer relatively stable income and diversification benefits. Moreover, it is also important to pay close attention to evolving tax laws that may affect returns, succession arrangements or gifting decisions. Moreover, it is also important to pay close attention to evolving tax laws that may affect returns, succession arrangements or gifting decisions.

These are not the only tax-efficient strategies. For example, using a Systematic Withdrawal Plan (SWP) from mutual funds may offer more tax efficiency compared to lump-sum redemptions, as it allows spreading withdrawals over time and can benefit from lower capital gains tax treatment. To further tailor your approach, connect with Shriram Wealth and get personalised wealth management solutions for your retirement plan

Plan for healthcare and medical cover

Healthcare is one of the most significant and rising expenses in retirement. Medical inflation often outpaces general inflation, making it critical to secure adequate health insurance well in advance. Policies purchased later in life not only come at a higher premium but may also exclude certain conditions or, in some cases, be unavailable altogether. A well-structured medical policy ensures that hospitalisation, long-term treatments and unexpected health costs do not erode your retirement savings. Including healthcare provisions within your retirement plan provides financial security as well as peace of mind, allowing you to focus on the lifestyle and goals you wish to pursue.

Address estate and legacy considerations

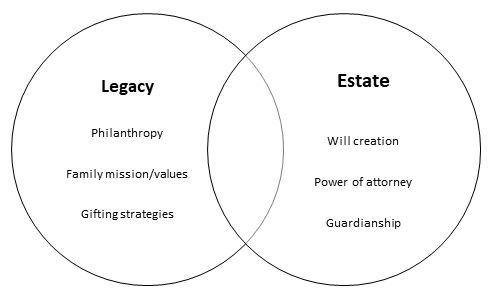

An estate plan ensures your wealth is transferred according to your wishes while providing clarity and stability for your family. This includes creating clear, legally valid wills and using trusts to protect assets, manage tax liabilities and control how wealth is distributed across generations. This is especially important if you have a family business.

Philanthropy is also an integral part of many legacy plans. Establishing charitable trusts or foundations allows you to support causes that matter to you while benefiting from potential tax advantages. Estate and legacy planning go hand-in-hand. Therefore, it is important that your retirement strategy addresses both efficiently.

Review and adjust regularly

Goals and circumstances keep evolving. Therefore, a regular review is an essential part of any retirement plan. Shifts in family priorities, market conditions or tax laws, all affect how well your strategy serves you over time. Periodic reviews help ensure your plan remains aligned with your objectives and continues to protect what matters most.

For example, an investor with significant real estate holdings may want to rebalance toward more liquid assets as retirement approaches. A business owner planning succession would need to adjust trust structures in order to reflect new family roles. Regular adjustment is not about reacting hastily but about making thoughtful, informed changes. This not only keeps your plan resilient and effective but also tailored to your evolving goals.

Get an expert opinion for your retirement strategy

You know your money better than anyone else. There’s no single strategy that suits everyone equally. With a mix of assets, equities, real estate, business interests or alternative investments, each portfolio has unique risks, opportunities and requirements.

A wealth advisor helps you bring clarity to these complex choices, align them with your goals and adjust your plan as life evolves. At Shriram Wealth, we offer personalised guidance to help you build your retirement savings. So, get in touch today and do not let the age-based assumptions define your plan.