Wealth in India is growing at a steady pace. According to Knight Frank’s Wealth Report 2025, the number of individuals with assets over USD 10 million rose by 6% last year to 85,698. It is anticipated to reach 93,735 by the end of 2025.

For women, this growing wealth landscape brings both opportunity and urgency. By 2030, women are projected to be the single biggest determinants of household wealth in India. In the top one-third of households alone, women already directly control around USD 1.2 trillion and influence another USD 1.2 trillion across spending, saving, investment and borrowing decisions. This highlights the scale of financial power at play, but also the responsibility to channel it effectively through structured investing.

Many women have already begun doing so by choosing to invest, diversify and plan their capital with intent. In a survey, it was observed 95% of affluent women showed interest in at least one investment avenue. Listed equities were the top choice, with 61.9% preferring them over gold at 54.3% and real estate at 41%.

What does this suggest? Women are participating, learning and leading with purpose. In this blog, we outline smart moves of investing for women. This will help you build capital with clarity, confidence and control.

1. Taking stock of your money

Capital must be preserved. It must also be placed correctly. Begin by mapping your holdings across three categories:

- Liquid (cash, savings, short-term deposits)

- Semi-liquid (certain mutual funds, debt instruments)

- Locked (real estate, private equity, long-term products)

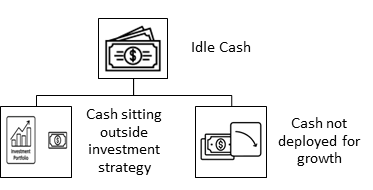

This exercise helps you see what is available for immediate use and what is tied up for the long haul. Too often, a significant portion sits in low-interest savings accounts. With inflation averaging 5% to 7% and savings returns around 3%, the money kept idle is actually losing value over time. This is what is called silent wealth erosion.

The remedy is not to abandon liquidity, but to use smarter vehicles for it. Idle cash can be parked in liquid mutual funds or flexi fixed deposits that retain accessibility while offering better yields. By making this shift, you preserve purchasing power and prevent slow erosion of wealth, all without compromising on safety or access.

A disciplined review reveals inefficiencies that often go unnoticed. It is the starting point for building a more responsive and intentional portfolio.

2. Building the three-layer core

Strong portfolios are built in layers, where each serves a clear purpose. The strength lies not in any single component, but in how these layers complement one another:

1. Emergency Funds

This is your foundation. Emergency reserves are meant to provide immediate access to money during unexpected situations. A good rule of thumb is to set aside 6–12 months of expenses if you do not have dependents and 12–18 months if you do. While these can sit in savings accounts for accessibility, placing a part in liquid mutual funds or flexi fixed deposits can preserve liquidity while delivering better returns.

2. Capital Preservation

Once the base is secured, the next layer focuses on stability. Here, the aim is not to chase high growth but to ensure predictability and lower risk. Instruments like tax-efficient bonds, high-yield fixed deposits, sovereign gold bonds and REITs can provide steady returns while safeguarding against inflation. Even digital gold can serve as a convenient way to diversify and protect purchasing power. This shields your portfolio from volatility while giving it resilience.

3. Growth

This is the engine of long-term wealth creation. It could be a combination of:

a. Public Markets

The most accessible entry point, including listed equities, mutual funds, customised PMS strategies and smart-beta funds that capture specific market themes. While they come with volatility, history shows equities tend to deliver higher long-term returns compared to most other asset classes, making them vital for beating inflation. Opting for direct mutual funds instead of regular plans also helps reduce costs, which can add up significantly over time.

b. Private Markets

These include private equity, venture capital and alternative investment funds. Although less liquid, they offer differentiated opportunities that are not available in the public space. At Shriram Wealth, access to such opportunities is streamlined through a proprietary deal desk that connects investors to curated deals with strong fundamentals.

Each layer serves a different goal, i.e., growth, access and protection. Together, they create a balanced core that works across phases and stages of your lifecycle.

3. Setting a liquidity ladder

One of the most practical ways to manage liquidity is to structure it by time. This means placing your capital into different tiers based on when you expect to need it. The first tier covers the next three months. This is your safety net. It should be parked in places where you can access it instantly, like savings accounts or liquid mutual funds. It is not meant to grow aggressively. It is meant to be ready.

The second tier looks ahead to the next twelve months. This is where you plan for known expenses like school fees, insurance premiums or a scheduled holiday. Instruments like short-term deposits or low-duration debt funds work well here. They offer better returns than idle cash, without locking your funds away.

The final tier spans the next thirty-six months. It supports medium-term goals such as renovations or business capital. Here, returns start to matter more and access can take a little longer. By laddering your liquidity this way, you protect your portfolio from disruption while staying ready for what life may bring.

4. Governing the portfolio

Once a portfolio is built, it must be actively governed. Wealth does not manage itself and markets do not wait. Regular oversight ensures your investments continue to serve their intended purpose. Asking the right questions to your wealth manager is as important as the answer itself!

Hold a quarterly portfolio assessment

One of the most effective practices is to conduct a quarterly portfolio review.This is a structured discussion with professionals from Shriram Wealth that looks beyond performance reports. It focuses on alignment. Are your current allocations still consistent with your goals? Has your risk appetite changed? Are there tactical opportunities worth exploring? These sessions are designed not just to track returns, but to make adjustments that keep the portfolio responsive to evolving needs and market shifts.

Re-underwrite private holdings annually

In addition to quarterly reviews, there is also a need for deeper, annual evaluation of your allocation across asset classes. Unlike public market investments, private equity, venture capital or long-term alternatives come with illiquidity and longer holding periods. These must be re-underwritten annually. This means reviewing each investment against its expected exit timeline, rechecking fundamentals and reassessing whether it still fits your overall strategy. Is the business on track for growth or facing delays? Does the revised outlook still justify your position? If not, exit planning or redistribution may be required.

Together, these two practices keep the portfolio grounded in reality. They replace assumption with clarity and intention with discipline. Good governance is not reactive. It is continuous, thoughtful and measured.

5. Learning and networking flywheel

Insight grows faster in the company of others. One of the most powerful, yet often overlooked, advantages in wealth creation is access to shared experience. Engaging with peer forums and curated communities of women investors allows for ongoing learning that no report or adviser alone can provide.

These spaces bring together India’s leading women investors to exchange perspectives, ask sharper questions and discover new opportunities. The conversations often extend beyond products and returns. They cover decision-making frameworks, lessons from exits and the evolving responsibilities of wealth.

The more regularly you participate, the stronger the flywheel becomes. Each interaction sharpens your judgment. Each connection widens your lens. Investing is no longer a solo effort, but a more informed and intentional one.

6. Access to thematic briefings and estate-planning workshops

Attending well-curated briefings and workshops helps investors stay informed about topics that often go unnoticed in day-to-day portfolio reviews. These sessions cover areas such as succession law, wills, family settlements and tax planning. The practical guidance from professionals helps create a space to understand how wealth can be preserved and passed on efficiently. For women who often balance monetary decisions within family and business contexts, these provide clarity, structure and the confidence to plan ahead with intent.

Partner with Shriram Wealth and take full control of your capital

In your journey to build lasting wealth, every move should be intentional. It is no longer enough to invest passively or rely on fragmented advice. What you need is structure, access and clarity at every stage.

From mapping idle capital to securing long-term legacy plans, each step in this approach is designed to put you in control, not just of your returns, but of your entire financial direction.

Shriram Wealth brings deep expertise, curated investment access and strategic portfolio governance to women who are ready to take ownership of their capital. Our approach is built around clarity, discipline and long-term capital growth.

If you are looking to invest with purpose and build capital on your own terms, now is the time to begin. Connect with our team and shape a portfolio that reflects not just where you are, but where you are going.